ct sales tax exemptions

Because Connecticut has just one sales tax and no discretionary taxes it is very easy to calculate your tax liability. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Download Or Email OS-114 More Fillable Forms Register and Subscribe Now.

. Manufacturing and Biotech Sales and. Sales and use tax exemption. Agile Consulting Groups sales tax consultants can be.

2 days agoConnecticuts Sales Tax-Free Week starts on Sunday. 2022 Connecticut state sales tax. Managing the sales tax process it is crucial to.

Factors determining effective date thereof. 7 on certain luxury motor vehicles jewelry clothing and footwear. Are drop shipments subject to sales tax in Connecticut.

2022 Connecticut state sales tax. It starts on Sunday Aug. Complete Edit or Print Tax Forms Instantly.

Ad Access Tax Forms. Exact tax amount may vary for different items. Exact tax amount may vary for different items.

Training and funding provided. Over 300 stakeholders are membersadvisors to the Council including business leaders educators philanthropic and community-based organizations. Our Connecticut sales tax book educates and identifies manufacturers on the states sales tax exemptions and associated requirements.

2022 Sales Tax Free Week dates are Sunday August 21 through Saturday August 27 2022. View examples of individual items that are exempt or taxable during Sales Tax Free Week. There are exceptions to the 635 sales and use tax rate for certain goods and services.

How to use sales tax exemption certificates in Connecticut. Page 1 of 1 Tax Exemption Programs for Nonprofit Organizations CT Use Tax for Individuals Examples of Clothing or Footwear That Are Exempt When Sold for Less Than. Exemption from sales tax for.

Ad 1 Fill out a simple application. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. 21 and continues through Saturday Aug.

Connecticut exempts winter boat storage and boat maintenance and repair services from sales and use tax CGS 12-407 2m 12-408 lD and 12-4111D. Ad 1 Fill out a simple application. 2 Get a resale certificate fast.

2 Get a resale certificate fast. 7 on certain luxury motor vehicles boats jewelry clothing and. As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability.

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. There are exceptions to the 635 sales and use tax rate for certain goods and services.

Go Paperless Fill Sign Documents Electronically. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. Calculating Connecticuts sales and use tax rates.

The statewide sales tax is 635 for the retail sale. Investments that help your business create jobs and modernize may be eligible for tax relief including. Exemption from sales tax for items purchased with federal food stamp coupons.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes. An organization that was issued a federal Determination Letter of. You may apply for tax relief on the purchase of.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes. FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut.

Sales Tax How Sales Tax Is Calculated Pipedrive

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax On Business Consulting Services

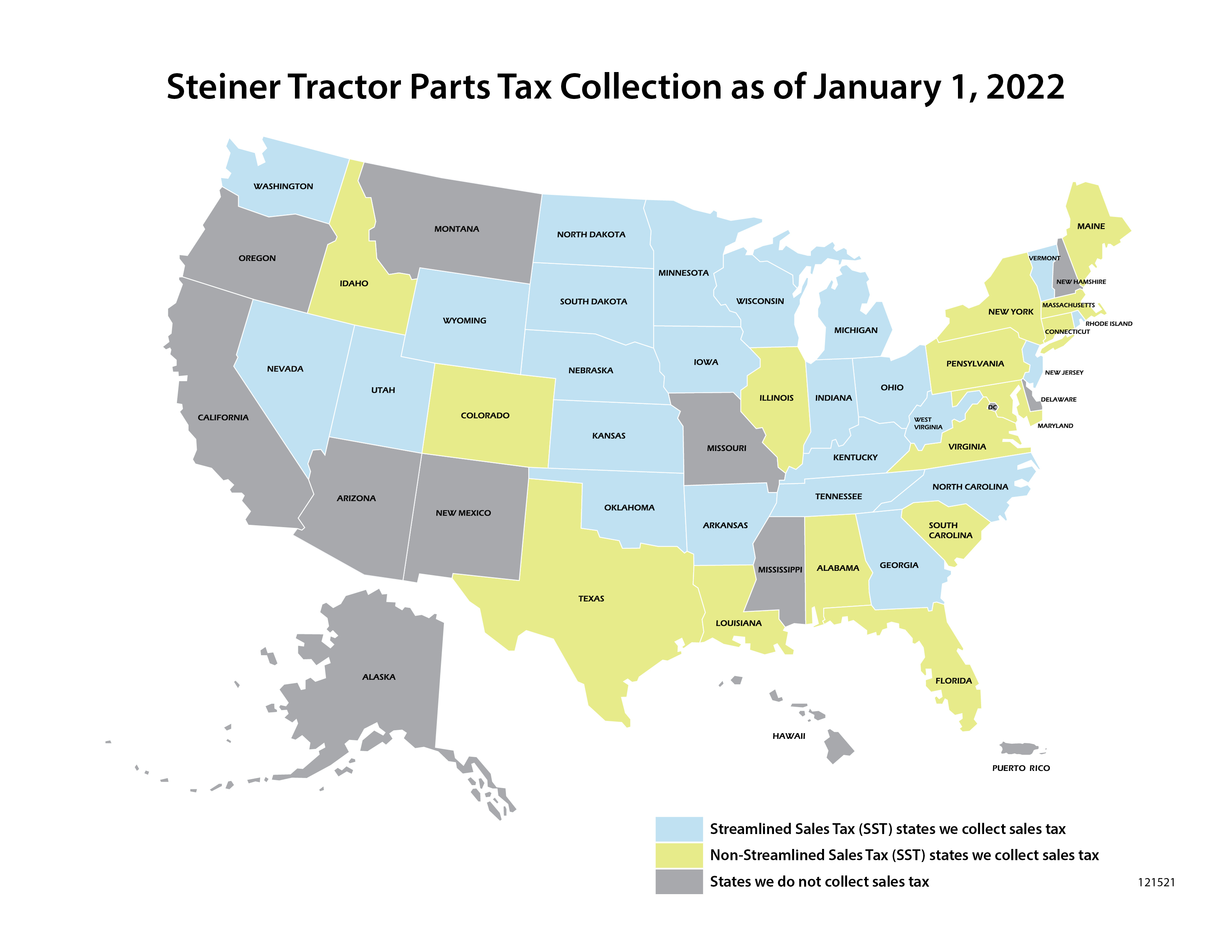

Sales Tax Information At Steiner Tractor Parts

Sales Tax By State Is Saas Taxable Taxjar

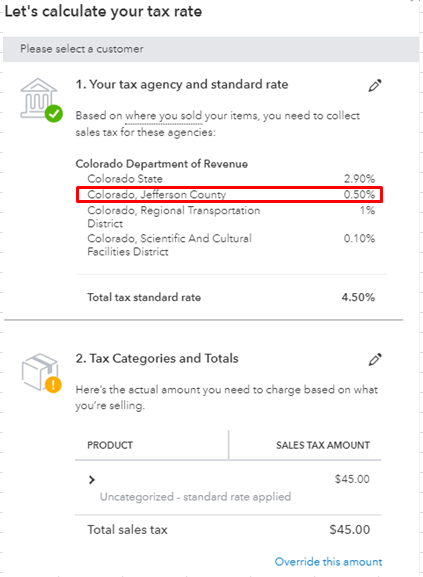

Missing Local Colorado Sales Tax Jurisdiction

How To Charge Your Customers The Correct Sales Tax Rates

Do You Qualify For A Sales Tax Exemption Youtube

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

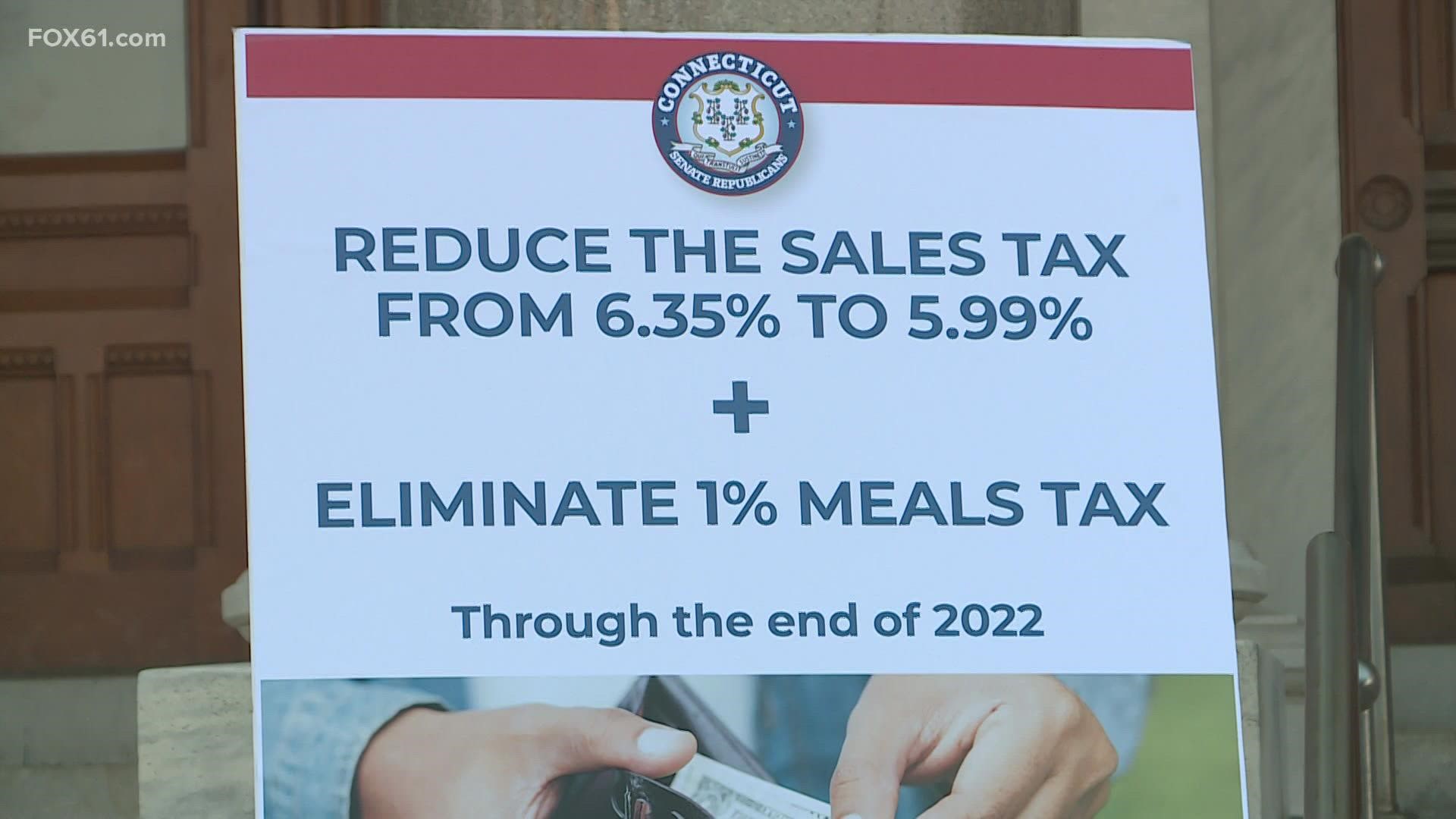

Ct State Gop Proposes Sales Tax Reduction To 5 99 Fox61 Com

States Sales Taxes On Software Tax Software Software Sales Marketing Software

Sales Tax Holidays Politically Expedient But Poor Tax Policy

How To Charge Your Customers The Correct Sales Tax Rates

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Ohio Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center